7250 Dallas Parkway, Suite 800

TRI DIGITAL

POLVORA

GLASSHIVE

MICROINFO INC

ARCTIC IT

ZODIAC SOLUTIONS

RENT-A-CENTER

2.0 TACO & TEQUILA BAR

BAHN SHOP

RESILIENT HEALTHCARE

RESILIENT HOME HEALTH

POST-ACUTE REHAB SOLUTIONS

NCD NEUROLOGY

SOUTHWEST SPIRITS

TOTAL CARE PPE

FUTURE COMMERCE

MOTOR HEAD HAT CO.

DALLAS SIDEKICKS

PUERTO RICE BLUE KNIGHTS

RAJASTHAN ROYALS

BARBADOS ROYALS

BTH BANK

ENCORE BANK

SALT & LIGHT ENERGY EQUIPMENT

Mezas has an appetite for debt deals. Mezas has a track record of successful investments and strong network relationships with both financial institutions & the business community

Given its experience and track record, a large numbers of potential deals are presented to the group, both from financial institutions and directly from potential clients

The end result is the ability to select only the most solid investment opportunities, which in turn will deliver strong results to investors and create lasting partnerships with our clients and financial institutions

With more than 90 years of experience, and an excellent investment track record, the team at Mezas has developed a large business network and earned the trust of investors

Additionally, a considerable part of the funds raised in each transaction is applied by Mezas using its own funds

This complete alignment of interests between Mezas and its investors is one of the key factors that explains its superior capital raise capabilities

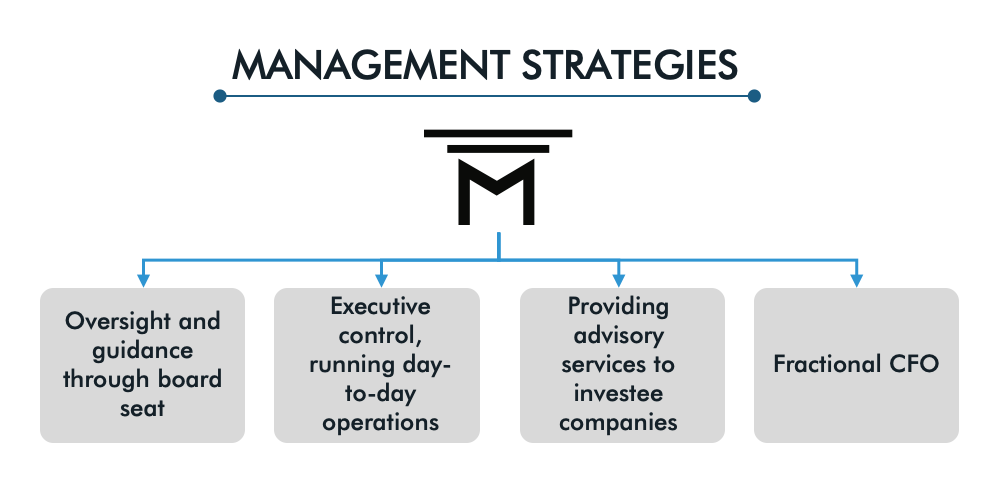

Mezas provides active guidance to its investee companies stimulating their growth while maximizing returns for investors

For some companies the Mezas team will take an oversight and general guidance role by having a presence in the executive board

In other cases, the Mezas team will have a more active role in the company’s day to day operations, either by taking a full time management role, or by providing some of its advisory services, such as Fractional CFO

Mezas framework can help companies evaluate their potential liquidity. We put a unique model together to meet our clients needs

Using its vast expertise and the relationships and ownership Mezas has established with lenders and investors, Mezas is able to support companies in obtaining strategic capital advantages in different areas

Services can include a range of strategic areas, such as structuring of financing packages for acquisitions, finding providers of growth capital to businesses, and restructuring of existing debt

The group is able to complete end-to-end deals, supporting both buyers and sellers with services that include valuation, target/buyer sourcing, due diligence and integration planning

Mezas mitigates challenges faced by companies when it comes to sourcing and optimizing the allocation of both debt and equity capital

Mezas provides advisory services for mergers and acquisitions, either to accelerate growth, take advantage of synergies, or to reduce competition in the market

Mezas provides exceptional financial expertise to small and medium sized companies that wish to grow their business but cannot afford the cost of hiring a full time CFO

With its Fractional CFO services, Mezas provides clients with a seasoned CFO with the necessary skills and expertise on a part time basis

The main areas of support are financial planning and analysis, guidance and oversight of financial budgeting and reporting, and leadership of the clients’ finance and accounting teams

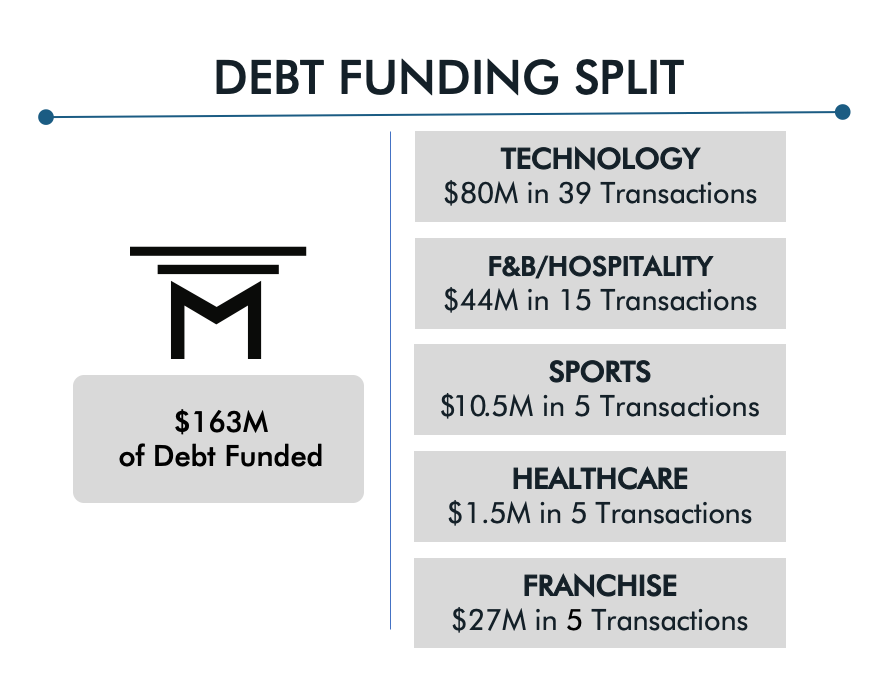

Thanks to an extensive network of relationships developed with regional banks and lenders, Mezas Capital Group is able to provide its clients with varied debt solutions and the most competitive terms.

The group is sector agnostic in its debt placement activities with a wide variety of industries.

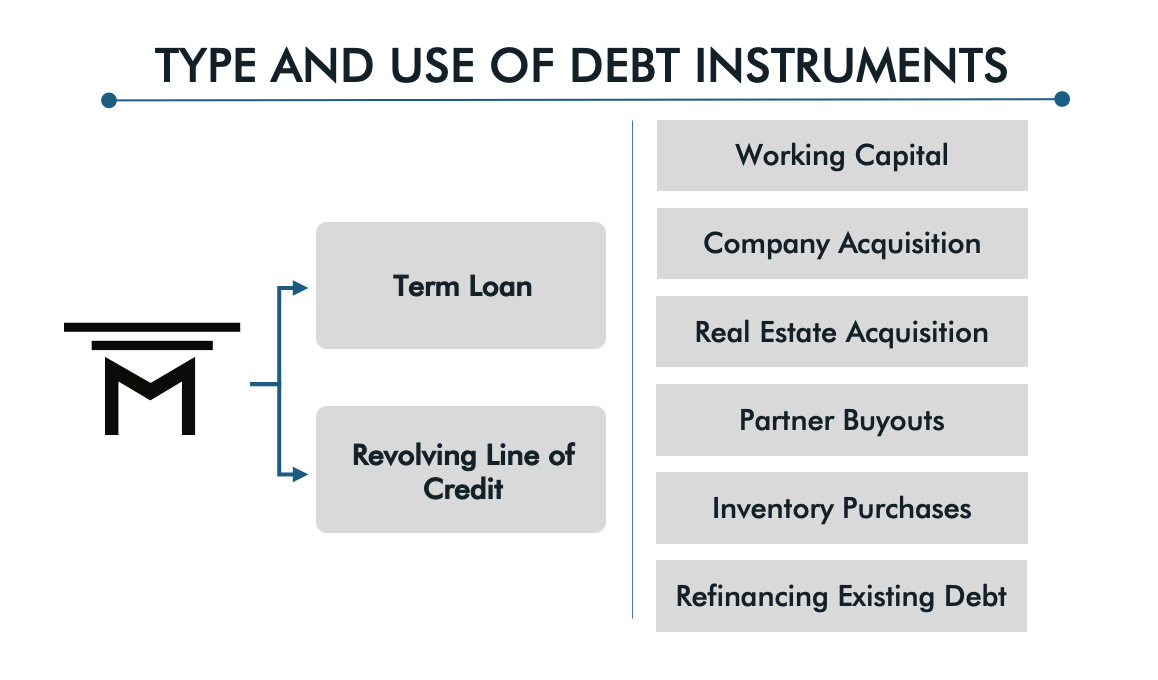

Debt placement is structured as term loans and revolving lines of credit, with the provided capital being used for:

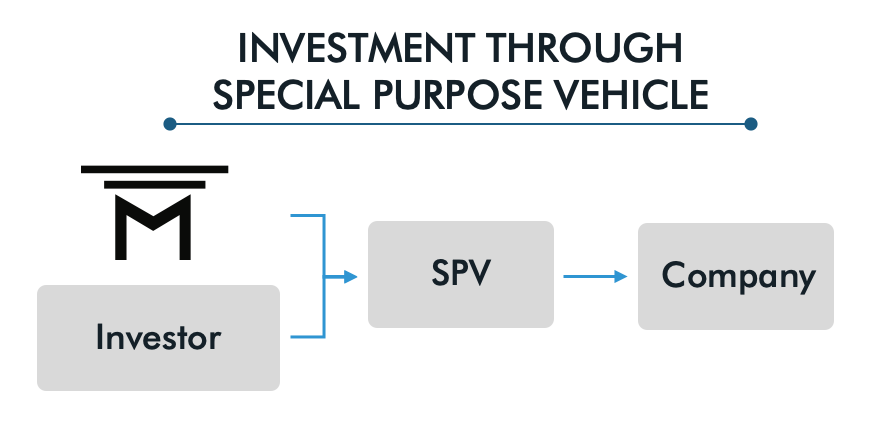

Unlike what is usually seen in the alternative investments sector, the group does not have a fund with committed capital to invest at its own discretion. Mezas’ transactions usually observe the following guidelines:

The group is sector agnostic in its debt placement activities with a wide variety of industries.

Depending on the type of transaction and the capabilities required, Mezas will have one of the following approaches:

For its debt placements, Mezas looks for opportunities that fall within the following criteria:

Mezas looks for investments that meet the following criteria: